Corporate Governance in the Middle East

Amarjeet Dutta – Partner, EMA Partners UAE, N Balakumaran - Senior Consultant, EMA Partners UAE & Rajesh Dahiya - Managing Director & CEO, GoodGovern

Over the years, corporate governance function has helped to hold companies accountable, while helping them steer clear of financial, legal, and ethical pitfalls. The benefits of a well structure corporate governance function in organisations has had visible benefits by instilling set policies and rules that has helped to bind complex organisations cohesively. It has inevitably been seen as a growing topic of relevance across the world, and it has risen by leaps and bounds in the last decade. Global focus on Sustainability and emergence of ESG frameworks, which focuses on stakeholder accountability as opposed to shareholder accountability is nudging the companies to relook at their Governance frameworks which in turn design and implement Environmental and Social programs. for The growth in institutional ownership, which was examined and addressed at the 2015 & 2021 review of the G20/OECD Principles of Corporate Governance, is one of the most significant trends in this regard. Further, changes to countries' corporate governance legislative frameworks are still happening: 90% of the jurisdictions surveyed have updated their company law, securities legislation, or both to accommodate developments since 2015.

Zooming into the Middle East, the propensity of putting more focus on corporate governance is significantly noticeable. In the early to mid-2000s, the Middle East as a region was often perceived as having an evolving corporate governance structure as compared to the rest of the world. This has improved appreciably over the last decade, with GCC member nations refining corporate governance frameworks while cautiously balancing the need to avoid introducing needless laws. Corporate governance measures (institutional ownership, government ownership, and board size) having a strong beneficial influence on firm performance in the Middle East. Formidable corporate governance processes are seen favourably by financial market players, which is reflected in the stock market values of corporations. Furthermore, good corporate governance processes continue to have an impact on a company's profitability.

Waves and Ripples – Growing demands of strong corporate governance measures

In the Middle East, notably in the UAE, the last 36 months have been the busiest months for companies going public. Going public is a massive undertaking in terms of establishing robust corporate governance and compliance systems. With growing institutional investment, there will be radical pressure on medium enterprises to achieve world-class status in the future.

In the United Arab Emirates, rigorous new corporate governance standards for public joint stock companies were adopted in 2020, in accordance with international best practices, with the goal of promoting accountability, fairness, gender diversity, and transparency. Some of the new additions to the standards are:

- Having a secretary on the board of directors

- The majority of the board should be independent and non-executive

- There should be at least 20% female representation on the board

- There should be policies on gender diversity

- There should be more clarity on risk management and governance processes

- There should be elaborate fitness criteria for members

- There should be guidelines for regulating subsidiaries, and so on.

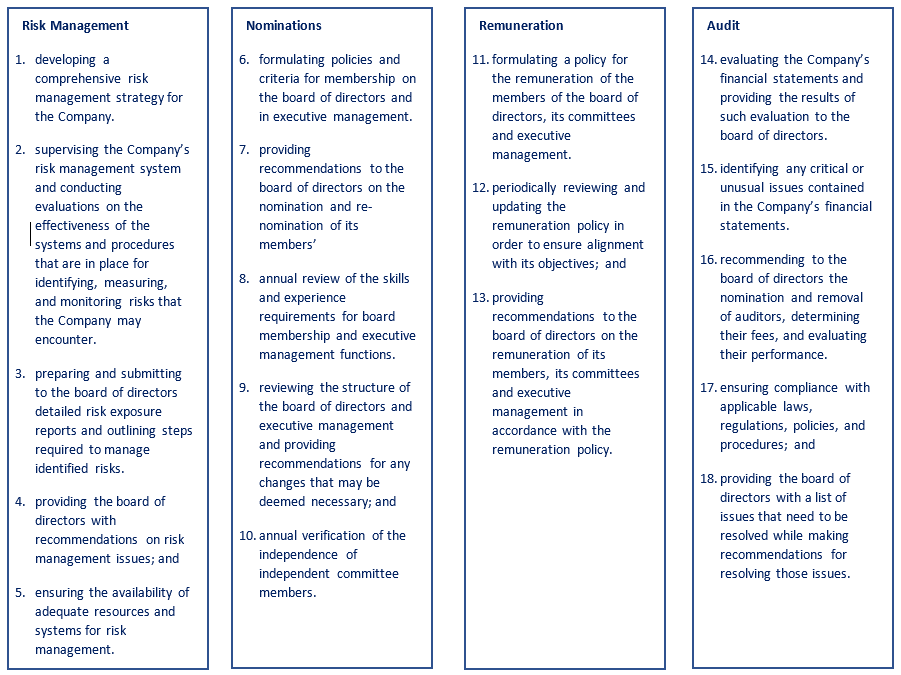

The Saudi Arabian Ministry of Commerce and Investment, in collaboration with the Saudi Capital Market Authority, has been active in developing and modifying corporate governance standards for both non-listed and listed firms. Six separate corporate governance resolutions have been made in the past decade to adapt to the initially UK-inspired corporate governance regulations to better match the Saudi Arabian setting. Remuneration and compensation reforms, executive compensation disclosure, shareholder rights and assemblies, development of strategy training programmes for board members, resolving conflicts of interest and strict disclosures, outlining audit, remuneration, nominations, and risk management committee responsibilities, and cycling of external auditors are just a few of the most important measures.

Other GCC member nations have implemented similar exercises, but it appears that the UAE and Kingdom of Saudi Arabia regions are leading the charge toward establishing a world-class corporate governance system.

Companies' challenges in keeping up with rising corporate governance needs

While Middle Eastern authorities and governments have been implementing severe compliance standards, enterprises have been forced to play catch-up while holding the fort without materially disrupting routine company operations. The following are some of the major obstacles:

- Adapting corporate governance procedures

- Policies/Procedures for detecting, evaluating, and reporting transactions between related parties

- Creating a strong company culture with strong principles to build sustainability

- Having a diverse composition of the board and its committees

- Unbiased and impactful Selection of board members done in accordance with global standards

- Defining, controlling, and monitoring the independence of board members

- Ensuring that risk management, compliance, internal controls, and internal audit work together effectively and collaboratively

- External evaluations of the board's performance – (growing criticality)

- Ensure that all subsidiaries have proper corporate governance procedures that adhere to corporate priorities and policies

Importance of establishing organisational Purpose, getting the right People & creating an efficient structure and Culture

It starts with the Purpose!

The Board exists for a purpose, and that purpose needs to inspire all stakeholders to continually stay invested in the organisation and participate in its long-term growth aspirations. Boards must continually revisit and review their purpose and goals and their alignment with stakeholders' interests.

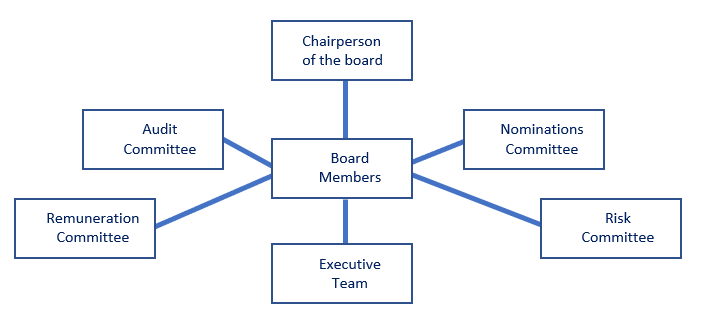

Board Structure: Depending on the size of the organisation, legal requirements, the nature of the business, and the mission of the committee, Middle Eastern corporations often have 6 to 11 (averaging 8) member boards. The structure of a company board might be in one tier or two tiers. Although numerous large organisations have shifted to a two-tier structure, popularised by giant MNCs, with a supervisory board and executive board, the one-tier structure remains the most common in the Middle East, especially among family-owned businesses.

Member profiles and committee structures: It has been observed that board room achievements are at their best when board members have subject matter expertise, a wealth of experience to draw on, specific industry knowledge, regulatory & legislative awareness, putting employee well-being first, and understanding the importance of generating value for shareholders. Extensive work happens in Board committees and it's desirable to have clear charters for all regulatory and progressive agendas covered in depth by Board Committees.. There is an increasing trend to have a separate Board Committee for “Corporate Responsibility” which focuses on the organisation's commitment to sustainable practices and social commitment

Diversity: Government regulators are increasingly requiring companies to have a gender-diverse board of directors. However, there is a strong case to broaden the scope of diversity and look at the diversity of skills, experience, leadership preferences and importantly geographical diversity. Members sought for specific committees, such as audit, must not only have audit experience but also have specific expertise in fulfilling the aims of the committee, such as monitoring effective GRC implementation. Aside from the functional and qualitative requirements, the members' trustworthiness should be a top priority

Culture: On the surface, the board's responsibilities are mostly supervisory in nature, articulating a vision and evaluating a strategy to maximise shareholder value, and ensuring that corporate governance in all forms is upheld to established standards. On the other hand, the company's culture is highly influenced by the board's actions and decisions. As culture begins at the top, board members must be the first to adopt and practise the cultural traits that they consider would best benefit the organisation. It is not only necessary for executive board members to lead by example but also for independent board members to do so. This notion of proactive leadership was notably evident during the pandemic when active boards that were ahead of the curve in terms of hybrid work models or pandemic work culture standards performed significantly better than passive boards that could only react.

EMA Partners & Good Governance Viewpoint

We at EMA Partners, we have witnessed a higher demand in the need for reputable and credible board members in organisations that are hungry to build sustainable businesses going ahead. This is true for non-Listed entities, ’well oiled’ start-ups and even small to medium enterprises. Prioritizing risk management, laying solid foundations for supervision, and focusing on long-term value generation are top goals for most companies in the aforementioned areas. Good corporate governance helps companies build trust with investors and the community, which acts as a catalyst for growth.

We firmly believe that the board of directors should consist of a diverse group of individuals, those that have skills and knowledge of the business, as well as those who can bring a fresh perspective from outside of the company as well as the industry and not just comprise of people who are familiar with the organisation.

To conclude, organisations that practise consistent levels of excellent corporate governance have a non-negotiable emphasis on the following areas:

- Board composition, diversity, refreshment, and leadership structure

- Long-term strategy, corporate purpose, and sustainability challenges

- Good governance practices and ethical corporate culture

- Human capital management

- Compensation Discussion and analysis

- Shareholder and stakeholder engagement

Good corporate governance leads to ethical business practices, which leads to financial viability which are based on principles around sustainability, accountability, transparency, fairness, and responsibility.

The past 24 months challenged most organisations on Business and Human Capital aspects, and it has been observed that companies who adhered to most of the above characteristics performed well and will continue to push the bar. It is perhaps unsurprising that nowadays we see a visible shift in which organisations acknowledge that corporate governance structure is no longer only a checkbox but a growing necessity!

Download the pdf: Download

Insights

Our Insights are the research and leadership trends that will benefit both clients and candidates, and inspire them to become better professionals