Industry 4.0 & impact on Singapore as a regional hub - A talent perspective

“The greatest danger in times of turbulence is not the turbulence – it is to act with yesterday’s logic.”

- Peter Drucker

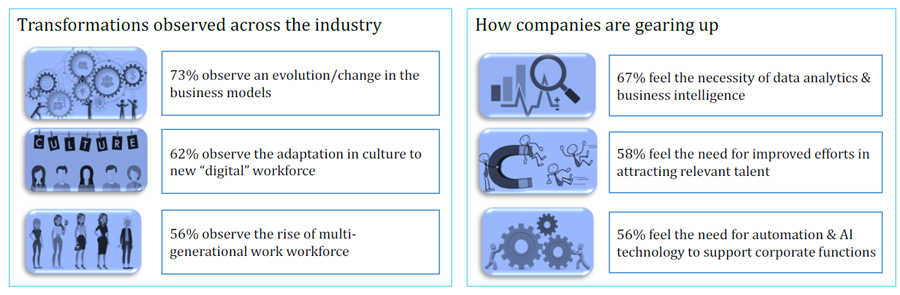

The world as we know it, is changing at an unprecedented rate. Businesses are no exception with the combination of emerging, connected and smart technologies resulting in the latest industrial revolution – Industry 4.0. Business landscape is evolving rapidly through some key advancements including Big Data, System Integration, Internet-of-things, Additive Manufacturing, Cloud Computing, Cyber Security, Augmented Reality, Autonomous Robots, and Simulations among others. Leaders in most companies are at a tipping point to embrace another wave of technological changes, especially in terms of how to attract and manage talent.

Drucker's words resonate with corporate leaders in ASEAN today more than ever, most of whom agree that talent attraction and retention in an Industry 4.0 world is increasingly difficult. Many of them question the relevance of a location-bound work model in a business environment where technology has enabled job types to be based anywhere, providing access to a wider talent pool.

EMA Partners Singapore, a Global Executive Search & Leadership Advisory firm, conducted a poll amongst prominent Business and HR leaders across Singapore on the topic “Industry 4.0 & impact on Singapore as a regional hub - A talent perspective” and discussed these findings at HR Connect, our quarterly roundtable of prominent HR leaders and business heads in Singapore during the first quarter of 2019.

Challenges in Talent Attraction

84% of the respondents from the poll agree that talent attraction has become increasingly difficult. Over the last decade, Singapore has embraced Industry 4.0 by being consistently top 3 in global competitiveness1, specifically in innovation and sophistication among others. Also, Singapore experienced high employee turnover where nearly half of the workforce switched jobs every 2 years2.

One of the leaders present at the HR Connect, a Senior HR leader of a large global pharmaceutical organization reiterated this point saying, “Singapore as a regional hub has a high bar for talent, not only do they have to be high quality but also cost-effective. It is incredibly difficult to attain this combination all the while maintaining your brand, especially for talent sourced from STEM (Science, Technology, Engineering, and Mathematics) background".

Job categories that are closely impacted by advancements in technology face the brunt of Industry 4.0 head-on. Unsurprisingly, our poll showed Digital/Technology and Operations job types are most affected as companies continually look for cost and process efficiencies. Curiously, the third job category perceived to be most affected is Commercial/Sales function which could be hypothesized to be a result of better customer analytics and a distributor driven approach.

The Chief People Officer of a large e-commerce business advised companies to make the first move to avoid being blindsided with sweeping changes to core functions. “It is important that companies look at different disruptive business models tailored to their context and not follow a set playbook”.

Are roles moving out of Singapore?

71% of the respondents from the poll agreed that certain job types within their company had moved out of Singapore in the last 5 years and were now based in a different country. Over the last decade, internet connectivity, new energy technology, cloud technology, and data analytics have enabled flexible and remote working. This coupled with other ASEAN countries providing mix business incentives and lower cost- recently upskilled workforce make it a case for companies to contemplate moving certain job categories to these countries. ASEAN countries generally rank quite high among the 157 countries measured in the Human capital Index3.

A prime example is cited by an HR leader from a consumer giant, “We were looking to improve cost efficiencies and were finding it difficult to compete for top talent. For marketing jobs, we moved entry and mid-level roles to Malaysia, while retaining high-value roles in Singapore. For technology jobs, we moved high-value roles to Vietnam. We were able to offer competitive compensation to our talent by choosing the right markets”.

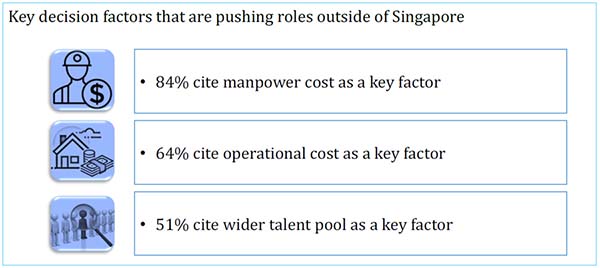

Manpower cost followed by overall operational cost and potential wider talent pool were the key reasons for moving some job types from Singapore to other countries. However, HR leaders agreed that quality level of talent available outside of Singapore must also be considered when taking these decisions.

EMA Partners Singapore has observed scenarios where large companies have moved their Regional headquarters out from Singapore, only to return a few years later for various reasons. Such moves have a lasting impact on the overall employer branding.

Build vs. Buy

![]()

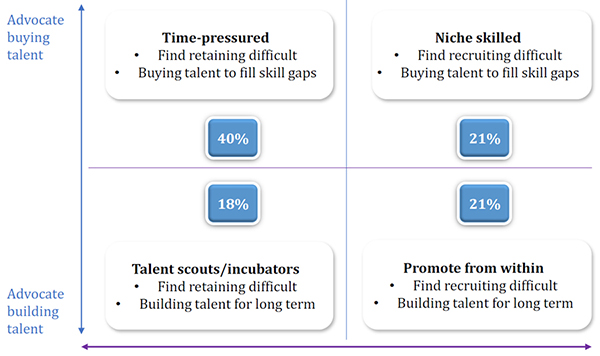

Advocating building vs. buying talent is constantly on the minds of HR leaders to pick the right approach for their organization. On the flip side of build vs. buy method is understanding the bigger challenge between retention or recruiting. We formed a talent matrix combining ‘advocating build vs. buy’ and ‘finding retention vs. recruiting as a bigger challenge’, leading to four archetypes of organizations – ‘time-pressured’, ‘niche skilled’, ‘talent scouts/incubators’ and ‘promote from within’.

From our poll, 40% of companies in Singapore are in a “time-pressured” scenario where they advocate “buying” talent to fill skill gaps. “Retaining” talent is seen as big challenge in Industry 4.0 and necessitates them to look externally and experiment with external service providers like RPO (Recruitment Process Outsourcing) as a stop-gap solution to keep up with growth scaling while creating breathing room to solve the retention problem in the long term.

Way Forward

Singapore has embraced changes and navigated its way to be the top location for global giants and regional corporations for decades. While its golden status has been brought into question with industry 4.0, it will positively hold on as the regional nerve centre housing regional leadership for a majority of companies.

The Regional HR Director of a large industrial corporation put it succinctly, “Singapore is still an attractive destination for talent as many employees are interested in being localized here. But other countries are no longer seen in relatively lower footing and are ready to step up for providing talent remotely across roles types”.

Another huge plus for Singapore is the stable government and regulatory environment. A senior HR leader at the HR Connect spoke about his company’s experience of being enticed to move operations to another country with attractive SEZ (Special Economic Zones) terms; only for the terms to change a year after the agreement was signed.

Decision makers would need to err on the side of caution when moving significant portions of their operations.

“Organizational moves based on improving profitability at times result in companies struggling to identify right leadership talent in a not-so-familiar market”, said Morgan Wee - Managing Partner of EMA Partners Singapore.

One of EMA Partners Singapore clients, a large multinational electronics company decided to move their global supply chain organization from Singapore to another ASEAN country citing cost benefits. A few years in, they realised it is a significant challenge to attract high-quality senior talent. EMA Partners Singapore partnered with them in the areas of talent acquisition leadership development and creating a pipeline strategy to cement the talent gaps.

The poll results also showed fungible role types will continue to move to other countries at a faster pace over the next 5 years. Companies would have to go through a cultural transformation for a multi-generational workforce, HR enabled people readiness and disruptive business models to surpass Industry 4.0 and on to the next wave.

The main theme coming up from the poll and the HR Connect was that moving to a “pure” location agnostic workforce is not a simple “plug-and-play” model. Companies will need to lay significant groundwork with a good mix of employer branding, retention programs and creative talent acquisition to be successful.

Insights

Our Insights are the research and leadership trends that will benefit both clients and candidates, and inspire them to become better professionals