Are C-Suite leaders ready for the resurgence? A MENA region perspective

Amarjeet Dutta and Bala Kumaran

What does MENA resurgence mean for C-Suite leaders

The Middle East and North Africa (MENA) region is recovering rapidly from the pandemic thanks to government led micro & macroeconomic measures and swift vaccination drives.

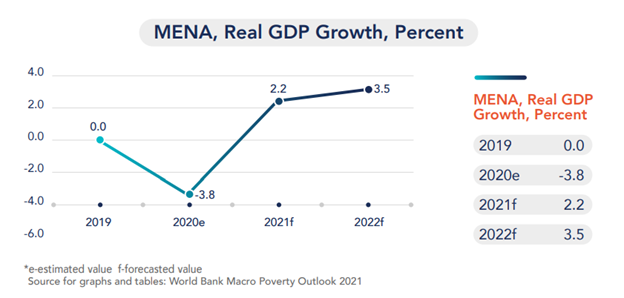

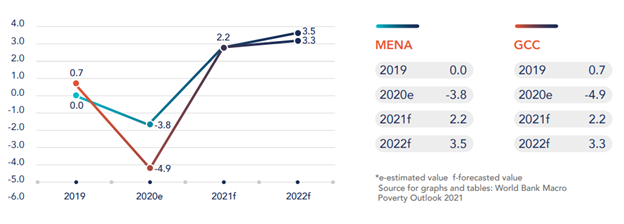

The pandemic had a significant impact on the region's GDP, which fell by 3.8 percent in 2020, forcing MENA governments to stretch their public debt, which is expected to climb from 49 percent in 2019 to 54 percent in 2021, to keep the economy afloat. The region’s GDP is expected to perk-up in the next two years, from 2.2 percent in 2021 to 3.5 percent in 2022 to pre-pandemic levels. However the World Bank has given a word of caution about the nature of the mounting debt, greater fiscal stimulus may be counterproductive, as recovery will be driven by rebound growth from pent-up demand for goods and services following the resolution of the health ecosystem.

In this study by EMA Partners, the macroeconomic parameters throughout the member countries of the MENA region are examined and what they would mean for C-Suite leaders. While the region may visibly rebound, the optimistic notion that individual businesses would thrive in tandem cannot be taken for granted. Rather than flowing with the tide and waiting for things to take their natural course, it is desirable to be highly proactive to create a sustainable upside. The first step in capitalizing on impending growth is to ensure that every member of the executive team is prepared, and in this study, we at EMA Partners examine some of those critical priorities.

Macroeconomic outlook across MENA

Gulf Cooperation council

In comparison to other MENA countries, the Gulf Cooperation Council (GCC)—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates—had reasonably robust healthcare infrastructure. The UAE and Bahrain are amongst the countries with the highest levels of testing per capita in the world, and GCC countries were among the first to receive immunizations, with the UAE and Bahrain leading the way.

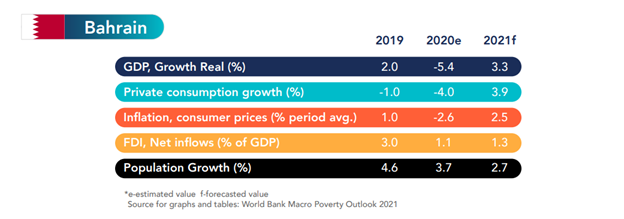

The outlook for Bahrain hinges on the uncertainty related to the pandemic, the effectiveness of the vaccine, evolution of global oil markets, and the reforms process. Economic growth is expected to progressively pick up to 3.3 percent in 2021, bolstered by non-oil activity. Under the fiscal balance program, steadfast fiscal reforms and better-targeted subsidies will gradually reduce the fiscal deficit. Bahrain's non-oil sectors are expected to rise rapidly in 2021, accounting for 90 percent of the country's GDP (which is a far cry from 55 percent in the 2000s). It is safe to argue that the whole recovery of Bahrain from the crisis hinges on how quickly the non-oil industries can return to pre-pandemic levels. The recovery is fairly evident from key growth sectors like Food processing, Apparel, and Transport & Logistics.

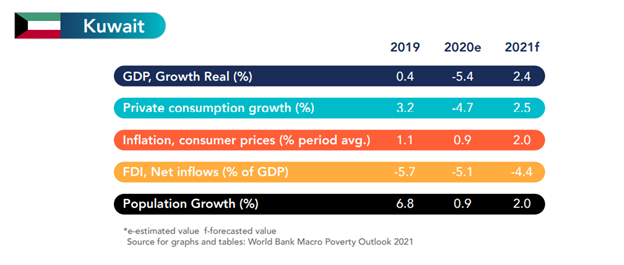

Kuwait's economy is predicted to rebound with 2.4 percent growth in 2021, thanks to a rapid increase in global energy demand and prices, while oil production continues to lag, increasing by only 0.2 percent, in line with OPEC commitments. Non-oil industries are expected to continue growing at a 4.4 percent rate in 2021, reflecting better domestic demand, as the immunization program gets traction and pandemic related restrictions are relaxed. While the non-oil sectors’ GDP is gradually recovering, it is unlikely to return to pre-pandemic levels until 2022. Non-oil sectors, on the other hand, are expected to account for the majority of Kuwait's expected GDP increase this year. In 2021, the recovery of real household spending and SMEs will serve as the two main drivers of non-oil sector development.

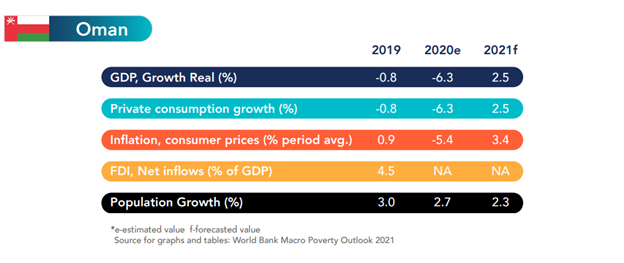

Overall Oman’s growth is projected to post a tepid recovery of 2.5 percent in 2021 supported by the vaccine roll-out and the ease in lockdown restrictions. A back loaded rebound will see growth peak at 6.5 percent in 2022 lifted by rising oil prices, and further development of the hydrocarbon sector, before declining to 4 percent in 2023 given fiscal austerity measures. The non-oil economy of Oman grew by 5.7 percent to USD 14.8 billion in the first quarter of 2021. With Oman entering its tenth five-year plan, the Government of Oman is counting on six key non-oil sectors to record incremental contributions and help the country navigate the crisis. Manufacturing, transportation and logistics, fisheries, mining, and education will all play a key role in achieving the 3.5 percent real GDP growth target for the five-year plan.

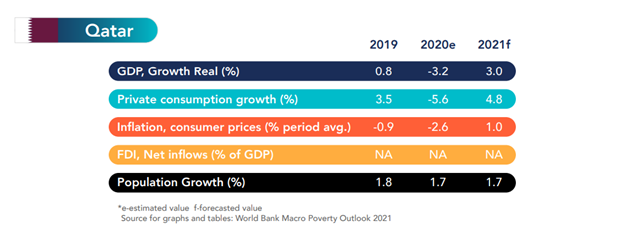

Qatar’s Real GDP growth for 2021 is expected to be 3 percent, with the same rate of growth for both oil and non-oil GDP, driven by domestic and foreign demand as vaccinations roll out and with the end of the diplomatic rift. Strengthening energy prices and final preparations for the FIFA World Cup 2022, as well as predicted record tourism receipts from what could be the world's first post-Covid big audience sporting event, should result in 4.1 percent growth in 2022, with non-oil GDP growing 4.9 percent (and oil GDP remaining at 3 percent). A strong early quarter in 2021 in the non-oil sectors to a great extent helped Qatar overcome the crisis. The Hospitality and food services segment saw a robust expansion (17.6%) along with transport & storage (12.9%), the wholesale & retail trade (7.7%), manufacturing (5.6%), and finance & insurance (4.3%).

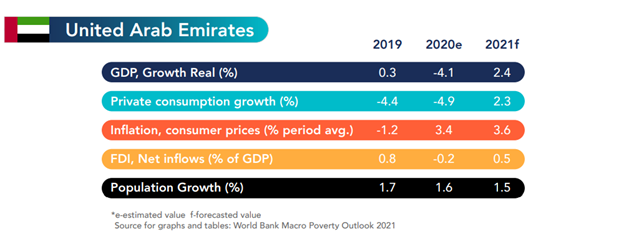

The UAE's economy is likely to improve in lockstep with the global recovery. With higher global oil prices, the hydrocarbon sector would regain strength. This, together with long term recovery in global trade and travel, would allow the non-hydrocarbon industry to revive as well. Normalization of relations between Israel and Qatar could open up new economic prospects. The UAE's non-oil private sector's business conditions improved in 2021, with the purchasing managers' index (which includes manufacturing and services) rising to 52.7 in April 2021, the highest level since July 2019. The pandemic effect will gradually be chipped down and pave as a stepping stone when paired with the UAE's foreign trade goal to expand non-oil exports by 50% with access to 25 new markets around the world. The revitalisation of Hospitality, Travel & Tourism, Technology, and Real Estate sectors are encouraging developments and will be beneficial for EXPO 2020.

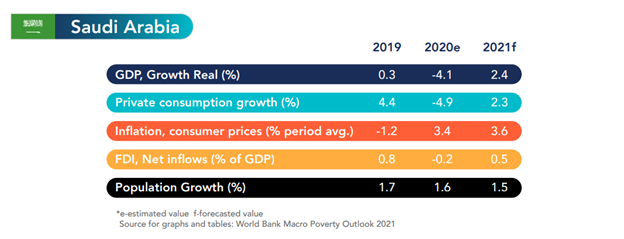

The economy is expected to grow by 2.4 percent in 2021, driven by an accelerated pick-up in global energy demand and prices and Saudi oil production level closer to its OPEC+ original commitment, resulting in oil sector growth of 0.5 percent. Non-oil sectors will continue to grow as the vaccination program gains traction and restrictions are eased, with growth expected to reach 3.5 percent in 2021, reflecting stronger private consumption, the gradual resumption of religious tourism, and higher domestic capital spending signaled by PIF's five-year strategy (2021-2025). In May 2021, demand growth in non-oil sectors, particularly healthcare, FMCG, and consumer electronics, accelerated further, indicating the largest increase in sales since 2019. Vision 2030 by the Government of KSA will be an added stimulus to the overall improvement and growth acceleration in the Kingdom.

Non Oil-Sectors and Other Countries Performance

Other Countries- MENA Region

The outlook for the economies of Other MENA Oil Importers (Djibouti, Egypt, Jordan, Lebanon, Morocco, Tunisia, etc.) is a "bittersweet story" of high debt, lack of structured governance, and the greatest potential for recovery to be better than pre-pandemic levels. The economies of Jordan, Morocco, and Tunisia, in particular, are likely to accelerate owing to rising export activity and agricultural output. Egypt, on the other hand, is anticipated to drop further following a 2% decline before recovering to 4.5 percent growth by 2022.

The pandemic, as well as the subsequent drop in oil prices, wreaked havoc on other MENA oil Exporters (Algeria, Iran, Iraq, etc.). On the back of increased oil prices and OPEC+ output limitations, the economy is expected to gradually recover. Low consumer and business confidence, little fiscal headroom, and high inflation could potentially constrain private consumption and keep the economic pressure on impoverished households.

MENA Non-Oil sectors performance in the recovery

The member countries have long recognized that dependency on oil-driven industries is unsustainable in the long run. Most governments are betting their recovery hopes on non-oil sectors, ranging from the UAE's foreign trade plan to increase non-oil exports by 50% to Oman's most recent year plan, which focuses on six key non-oil sectors, to Bahrain shifting its GDP dependence to non-oil sectors by 90%. Across the board, most MENA countries witnessed an increase in purchasing manager’s index, household income spends, and a decrease in unemployment from non-oil sectors. There is enough traction for non-oil sectors especially manufacturing, technology, healthcare, transport & logistics, trade, and hospitality sectors to gain control from oil-driven economies in the region.

Preparedness for capitalizing on impending rebound

With the economy rebounding rapidly, executing the same leadership strategies of the pre-Covid era may prove to be no longer viable and effective. Every C-suite executive today should reassess their priorities, watch out for potential roadblocks and possible blind spots. The Board, the CEO, and the rest of the C-suite talent are all responsible for regaining the growth and momentum. The "distributed leadership model" is a key element for most progressive organizations in their effort to recover their businesses rapidly and effectively.

Here we look at some of the key priorities of leaders as the economy in general and businesses at large are expected to rebound.

Priorities:

Board of Directors

- Align strategy and capital allocation with long-term value creation drivers

- Diligently review & Improve preparedness and resilience to potential crises and systemic shocks

- Integrate material environmental, social, governance and data stewardship (ESG&D) factors into enterprise risk management

- Prepare the company's mainstream reporting in an integrated manner, especially with conglomerates

- Strengthen corporate governance and periodically review with all concerned for progress and blind spots

- Adopting an effective 'zoom in' and 'zoom out' approach

Chief Executive Officer

- Creating an Agile culture, with the capacity to respond swiftly

- Being ‘predictive & prescriptive’ rather than ‘descriptive & diagnostic’, and leveraging data to accelerate execution

- Getting back to basics - cross selling and upselling to existing customers to create more upsides

- Make technology matter more, technology enables agility and is growth driver.

- Using simple technology to establish internal communication platforms for employee reach outs and feedback mechanisms

- Focusing on people agenda and driving growth through high potential talent

- Have ‘playbooks’ ready when needed as per changing situations

Chief Financial Officer

- Focus on rebuilding revenue streams, incorporating environmental, social & governance (ESG) mandates and ‘scenario planning’ with emphasis on treasury and cash flow management

- Streamlining budgeting processes to respond more quickly and efficiently, such as stress testing scenarios and assumptions to mitigate uncertainty, focused review and zero-based budgeting, reducing central spending as a contingency, and assigning specialists to high-priority areas.

- Using horizontal digital platforms to create collaborative dashboards and financial forecasts

- Build buffers for inventory, especially for “bottleneck” components and capital, so that periods of significant cash flow reduction can be withstood, given such a scenario in the future

Chief Operating Officer

- Transition from a typical role focused on vital assets and operations to a catalyst that drives transformational change by developing new, innovative ways to serve customers, markets, and channels, while driving operational excellence

- Revaluate supply and demand side processes, systems, and workforce, using lessons learned from the pandemic.

- Shift from a defensive to an offensive posture, i.e. shift strategy and focus away from crisis management and business as usual and divert more time towards generating market distinctiveness.

- Set clear risk thresholds and don't accept or avoid operational hazards that go beyond them.

- Give data its due—ensure that data utilized in resilience planning and execution is recent, accurate, and sourced from trustworthy sources

Chief People Officer

- Employers are eager to re-establish a strong in-person presence. Employees are really not quite there yet. A spike in attrition and disengagement could be on the way — HR leaders will need to pay close attention to one aspect of this to ensure the long-term sustainability of people and performance.

- Accelerate new ways of working incorporating remote work, flexible work and reviewing work design and architecture

- Developing a “post-pandemic mind set” for equitable and sustainable incentives

- Supporting digitisation across all HR functions and ‘automation’ adoption across most possible platforms

- Championing diversity and inclusion, employee well-being, and transparent performance metrics to create a challenging and vibrant work environment

Chief Marketing Officer

- Balance risk aversion with market growth through finding the right balance of customer retention and new customer acquisition

- Choose which strategies to reinvent and ones to be rescaled, - prioritizing short-mod-long term and ones most aligned for growth in the current quarter

- Focus on a Quarter to Quarter approach instead of Year on Year

- There is a strong correlation and interconnectedness between brand experience, customer experience, and employee experience. Take advantage of marketing's increased remit to re-establish marketing as a revenue generator in addition to demand creation, advertising, and promotion.

- Since Online purchases increased substantially, focus on creating ‘Stories’ (across all channels) around brands for better consumer connect will be critical

Chief Technology Officer

- Increase emphasis on data and cybersecurity by converting to cloud security

- Bridge the digital divide of not having the right infrastructure to execute

- Accelerating hyper automation with intelligent decision making by adopting the philosophy of "everything that can be automated, should be"

Chief Legal Officer

- Instead of looking for ways to decrease cybersecurity budgets, general counsels are now taking the lead in designing plans to minimize an ever-growing field of data threats and their potential costs.

- The majority of general counsels have increased the use of artificial intelligence (AI) for legal operations, the overall number of distinct software products found in legal teams' technology stacks, and the use of SaaS and other cloud-based technologies to execute legal tasks.

Our perspective

The economic impact of the pandemic is yet to be fully realized. Governments and businesses continue to be in a ‘wait and watch’ mode even as we are witnessing green shoots. Individual businesses have to reassess their challenges in a dynamic environment and build agility & resilience within their organizations. Boards and C-Suite leaders must focus on managing periods of uncertainty, ambiguity coupled with high-growth opportunities.

In the long run, businesses will realize that resilience is a capability that must be mastered and honed, not an alarm that must be activated in case of a crisis. At the same time, agility is the key, more-so in times of crisis. Hence, companies have realized that building an organizational culture which supports quick decision making is critical to growth in good times and also to ride through crisis situations.

We have also noticed that throughout the pandemic Boards have stepped up, improving collaboration, implementing new processes, focusing on resilience. In addition, the boards have collaborated proactively with the CEO and executive team.

The key aspects that will matter the most in the next 12-18 months will be strong governance, organizational resilience, building empathetic and impactful human capital policies, building digital as a horizontal function, building highly modernized virtual customer support platforms.

References Are C-Suite leaders ready for the resurgence? A MENA region perspective

Insights

Our Insights are the research and leadership trends that will benefit both clients and candidates, and inspire them to become better professionals